IRS Issues Notice to Extend WOTC Form Filing Deadline

On April 9, IRS issued Notice 2020-23 to provide relief relating to certain deadlines for taxpayers in response to the COVID-19 national emergency, declared in March of this year. Under the notice, a “time-sensitive act” due to be performed on or after April 1, 2020 and before July 15,2020 can be performed by July 15, 2020.

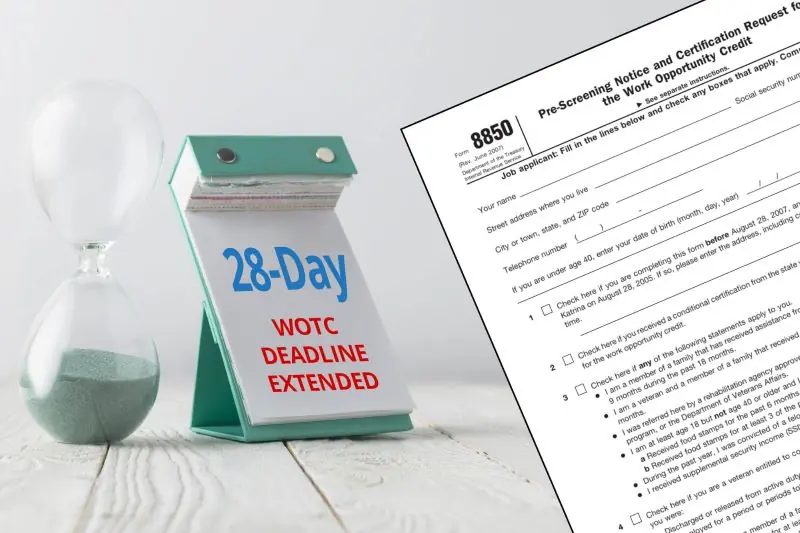

While WOTC and Form 8850 were not explicitly mentioned in the notice, the Notice explicitly includes as an “Affected Taxpayer” a person performing any of the time-sensitive acts identified in Revenue Procedure 2018-58, which provides an updated list of time-sensitive acts that may be postponed in the event of a federally-declared disaster, under Section 7508A. The list includes employers pursuing Work Opportunity Tax Credit (WOTC), which requires the filing of Form 8850 with a State Workforce Agency no later than 28 days from the employee’s start date. As a result, the filing deadline for 8850s due between April 1 and July 15 has been extended to July 15, 2020.

This is great news for employers that may have missed 8850 filings during this time period. This also demonstrates the overall strong support of the WOTC program. In the coming days, Walton’s team will work with employers impacted by this notice to take advantage of this great opportunity. In the meantime, if you have any questions, don’t hesitate to contact us.